Table of content

“Customer experience is the new financial services currency”. That’s how a study by Econsultancy begins.

Actually, customers should be the main priority of any business. And I’m not the only one who believes so. A study revealed that 67% of the surveyed customers think a bad customer experience is enough to leave a company.

The financial industry has to catch up with this reality as well.

Especially when there are huge amounts of money at stake and many companies fighting for customer attention, it’s no longer enough to just meet their needs.

Offering an amazing customer experience means going beyond.

You don’t need magic tricks for this. Technological innovation is on your side.

Customers and financial institutions: Two sides of the same coin

Nowadays, people are used to self-managing their issues through websites or mobile apps.

They want to pay off loans, open bank accounts, or purchase car insurance quickly and easily. If communication with companies is complicated and they cannot perform everyday banking tasks, they will have negative opinions about those companies.

Also, they don’t want to be treated as just a number. They expect companies to be familiar with them, to know their names, preferences, and, if need be, which football teams they cheer for.

All in all, they want to feel special.

Additionally, many financial companies face a double challenge: offering what their customers need and adapting to digitalization.

Telephone support has been the main contact channel for addressing customer inquiries for years.

Plus, costs still are a concern. Offering flawless customer service to thousands of people can become a pain in the neck.

Related article: How financial institutions can reduce customer service costs using chatbots

Digital solutions for financial institutions

Given this scenario, customer experience cannot be neglected. Offering amazing service is a source of endless benefits for a company.

That’s why we’re going to tell you the 8 keys that will take any financial institution’s customer service to the next level.

1. FAQs will no longer waste your team’s time

If your agents are overwhelmed by a huge amount of customer inquiries, automation is a great choice.

By adding a chatbot with AI, you’ll be able to answer the simplest FAQs.

And you don’t have to worry about setting it up. Starting up Aivo’s chatbot is simple, fast, and you don’t need IT expertise to do it.

Your job will be to think about the topics your customers consult the most. The bot will do the rest.

Additionally, sometimes users are afraid of chatting with the bot or aren’t sure how to ask for the information they need. That’s why the virtual assistant can suggest question options when they visit a website.

This way, you ensure everyone gets what they’re looking for.

2. Bots and humans, together on the same mission

Certain questions cannot be easily answered by generic instructions from the bot. Examples of these include card termination or taking out a mortgage loan.

In these cases, you can choose to transfer the session to a live chat. For example, the Aivo Suite live chat solution allows you to configure a derivation to an agent from the AgentBot platform.

Thanks to this feature, the customer will talk with a person and solve their problems in real time or asynchronously.

3. They want it, they got it: 24/7 customer service

Chatbots don’t have business hours or take time off. Whether it’s Monday, Wednesday, the weekend, or a holiday, a conversational bot is always available.

Unless you hire a special team, providing customer support during non-business hours would be impossible without a virtual assistant.

If you want to see a real success story, you can read about Easynvest. The company uses AgentBot to offer their customers information about passwords, electronic signatures, deposits, investment funds, and much more. This takes place instantaneously without making their customers wait.

4. Bulletproof security

This is key. In order for people to trust a financial institution, they have to feel that their money and data are protected. There’s a lot of risks and one mistake could lead to severe consequences.

This is why it’s essential that digital tools meet international security standards.

First, ensure that your selected digital solution offers Secure Socket Layer, the password encryption protocol. With this resource, you’ll protect passwords, usernames, and any confidential information your customers enter in the virtual assistant.

It’s also important that the solution has redundant infrastructure with self-escalating capacity. This way it will be able to adjust to increasing demand and company growth.

Finally, ensure it has a high Service Level Agreement with public access. This will allow you to monitor the service status and quality in real time.

5. All channels lead to omnichannel solutions

While offering digital contact channels is the first step towards improving communication with your customers, there’s another factor you need to consider: integration. If there’s no synergy between them, the interaction may not be as effective.

How could you make a customer happy if they have to repeat the same story via email, web chat, and live chat whenever they have a problem? With an omnichannel solution, you’ll finally be able to please them.

By integrating all the contact channels, the customer will get the same service regardless of which one they use to contact you. The conversation could go on smoothly even if they change channels.

6. Just like a conversation with friends

The one talking to customers is a machine, I know. But a chatbot powered by artificial intelligence is not just any machine.

Thanks to this technology, the Aivo chatbot understands emojis, colloquial language, and even spelling mistakes. It can detect the intentions behind customer inquiries regardless of the written text.

That’s how the empathy and ease of everyday language is maintained during contact with the customer.

7. Answers with a WOW effect

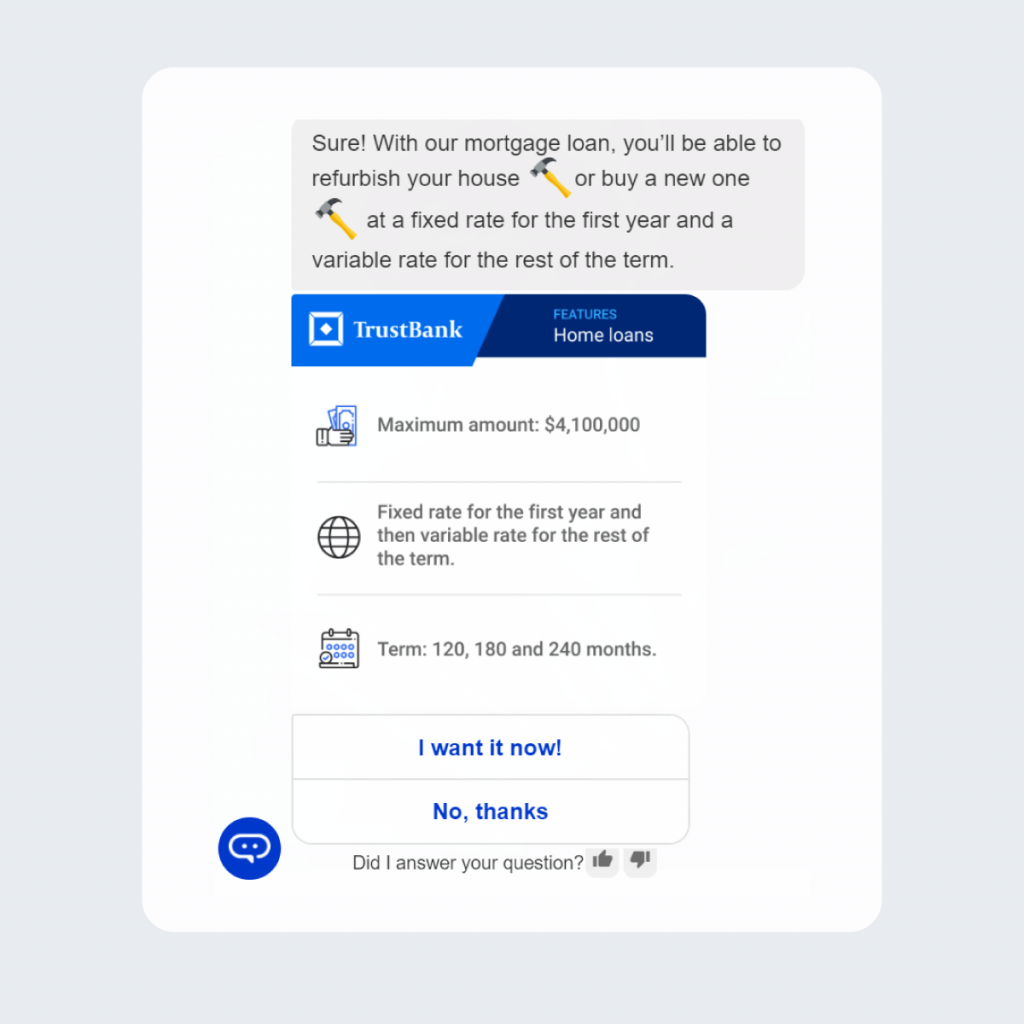

Text alone may be boring. If you want to surprise your customers with entertaining conversations, smart chatbots make this easier.

For example, the Aivo virtual assistant allows you to add complements to answers. Videos, images, gifs, assisted navigation, forms, embedded maps, carousels, and buttons: there are many options.

What’s most important is that you think about which one is ideal for each question. Then, adding it to the questions is a piece of cake.

With a form, your customers will be able to check their most recent account transactions or increase their credit card’s temporary limit.

Carousels are perfect for showing products, payment methods, or the latest deals in a sequence of images.

You can also add buttons when answers are more complex and you need customers to choose from many options. Plus, buttons allow you to place a link to an external website or to another previously entered intention.

With these complements and a bit of creativity, you’ll have a bot full of entertaining and informative content.

Just keep in mind that different channels have different rules and they don’t display complements in the same way.

8. Measure and you’ll thrive

AI bots also offer reports and analytics from their platforms. With this data, you’ll learn more about the virtual assistant’s behavior and how your customers use it.

From the Analytics section of Aivo’s chatbot, you can view graphs and stats about sessions, transfers, and interactions between the bot and your customers.

For example, you’ll see your customers’ FAQs, the number of inquiries efficiently solved by the chatbot, the most commonly used contact channels, feedback after the bot is used, and chat reports.

The Training section also shows the questions the bot hasn’t been able to answer. That’s how you’ll know what new content you should add to its knowledge and what to improve.

To sum it up, your own customers will help you refine the way you interact with them.

All this information is super useful when enhancing customer experience and thinking about communication methods that truly surprise them.

Innovation aligned with your strategy

As you have seen, using innovation to improve the financial services experience is a one-way street. Undoubtedly, digital solutions for customer service have great benefits for companies.

However, you should explore your possibilities and see which technology suits you best.

As Juan Biondi, Head of AI in Aivo says, “there’s no use in adding AI just for the sake of innovation. Its use has to be shaped by a strategy that is aligned with the goals and mission of the company as a whole.”

How do you think innovation can enhance customer experience?